Thought of the Week - The Hitchhiker’s Guide to Investment Research, Part 1: Busy Fools

It is summer and I thought, before many of us go on our summer vacation, I’d post a series of philosophical thoughts. I have been doing investment and macroeconomic research throughout my entire career in finance and younger people sometimes come to me to ask how I do it, and why I do things differently than other analysts. What follows is my personal view, so no offense to any readers, but I think most economists and strategists working at banks and asset managers preoccupy themselves with the wrong things and thus waste a lot of time producing research and forecasts that are useless for investors. And unlike in academia, the job of an economist or a strategist in the private sector is to help people make money. So, with apologies to Douglas Adams, here is a trilogy of posts on my way of doing investment research that I like to call “The Hitchhiker’s Guide to Investment Research”.

In my office, I sit next to a guy who I like to think of as an ‘undercover philosopher’. This guy, let’s call him Ed because that’s his name, has a knack for coming up with phrases that sound like they are just thrown into the conversation to be witty, but that stick in my head. The longer I think of them, the more I am surprised by the deep truth buried in them.

Many months ago, we were chatting away and he said that in the investment world, it is easy to become a “busy fool”. And come to think of it, he is right. The investment world has become dominated by data, and especially in the world of professional finance, data providers like Bloomberg, Factset or Refinitiv allow you to download and analyse enormous amounts of data on any company or market in a few minutes.

The notion is that by analysing more details of a company or a market one may be able to make better forecasts or assessments of the “fair value” of a company or market. But instead, I think one is at risk of becoming very busy doing things that in the real world have hardly any influence on the outcome of a specific investment.

I used to work at a major bank where we ran a valuation model for equity markets. This model consisted of a four-stage discounted cash flow model, where for every stage in the model one had to estimate growth rates for earnings, payout ratios for dividends, the real risk-free rate, the inflation premium, and the risk premium for each market. That is some 20 variables for each market, none of which is observable in real life, but must be guessed from theoretical models and analysis of long term trends.

Sometimes, we spent half a year analysing the impact of demographic change or climate change on the equity risk premium for a specific market. After six months of work, the result was that we changed the equity risk premium by 0.25% and the fair value of different markets hardly changed. Even worse, there was a discussion among the strategists that despite using some 20 parameters to estimate fair value, the model itself was so sensitive to some parameters that one couldn’t change them without adjusting other parameters, or the fair value would double or decline by 80%. At which point one of my mentors told my boss that if you have a model that is that sensitive to unobservable parameters, you probably have an ill-specified model. Today, I know he was right…

That may sound like an extreme example, but similar busy fool behaviour happens all the time in our industry. Economists and investment strategists are constantly asked to provide an outlook for the coming 12 to 24 months. What do they do to deal with these requests?

Strategists preoccupy themselves with trying to estimate earnings growth over the coming year to estimate where share prices will go. Mind you, there are people employed at major banks whose only job is to look at the earnings of the S&P 500 and forecast earnings growth for the coming year. I don’t even bother with that and here is why.

First, let me state that over long time horizons like ten years or so, earnings growth is a key component for equity market returns. But has any strategist ever looked at the relevance of earnings growth for shorter investment horizons? Probably not, because if they had, they would stop trying to forecast next year’s earnings growth.

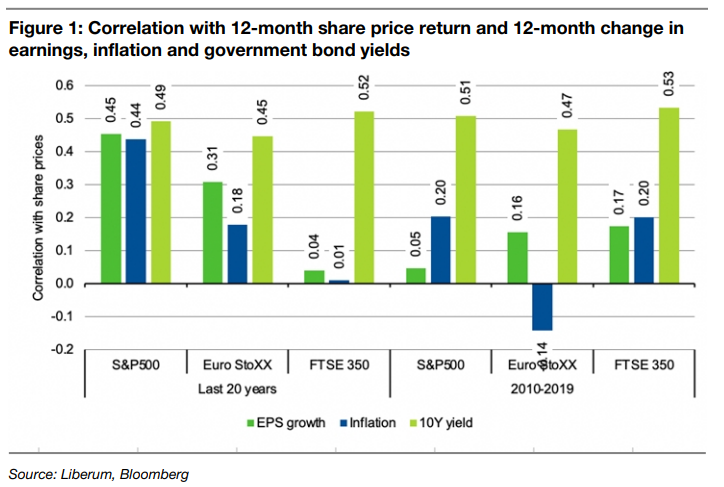

The chart shows the correlation between annual earnings growth and share price return in three major indices over the last 20 years from 2002 to 2022. Note that being able to forecast earnings growth in the next 12 months will give you a correlation of 0.45 with the return of the S&P 500 in the coming year. Not bad, but if you look at Eurozone equities or UK equities, you will find that earnings growth has indeed a rather low correlation with market returns. And most of that correlation comes from the two major market crashes of the last 20 years. If I exclude the financial crisis of 2008-2009 and the pandemic of 2020-2021 and only look at the decade from 2010 to 2019, I end up with a correlation between earnings growth and share price return of 0.2 or less.

In any given 12-month period, market movements have hardly anything to do with earnings growth. Instead, the correlation is much higher with changes in interest rates, in particular 10-year government bond yields. Over shorter time horizons, changes in interest rates are by far the most important driver of stock market returns. Changes in inflation is the other variable that has a material influence on short term market returns and particularly in normal times, as between 2010 and 2019, was more important than earnings growth.

Yet, I don’t often see investment strategists trying to forecast changes in government bond yields and inflation over the next 12 months to get a sense of where markets are heading. I do it all the time, but I seem to be rather alone in that effort. Instead, people are wasting enormous efforts on trying to forecast earnings growth, despite the fact that this has less influence on the return of a portfolio than interest rates and inflation.

There are plenty more of these examples, but this first part has already been going on for too long. So let me emphasise once again, that in order to be a useful and good investment strategist or economist, one needs to focus on what really matters for real-life investments, not on what should matter. I have a rule that I only work on topics where there is empirical evidence that the topic I am working on is making a difference in real-life investments. If I don’t have that evidence, I won’t do it because I would waste my and my clients’ time.

Unfortunately, too many people in this industry, who work as economists, investment strategists and in similar positions, not only don’t focus on topics that matter, but instead justify their work by the fact that in theory the topics they work on should matter. And this reliance on theory will be the topic of tomorrow’s part 2.

Thought of the Week features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to joachim.klement@liberum.com. This publication is free for everyone.