Thought of the Week - Want to hurt your competition?

I tend to say that there are only three ways to be successful: be faster than others, be better than others, or be different. To which some smart people have replied that there is a fourth way: cheat. Obviously, you should not cheat, and I don’t condone cheating in any context. But in financial markets there is a grey zone that some people like to use and abuse: rumours. Financial markets are full of rumours all the time and it seems they do have consequences that go beyond the share price of a company.

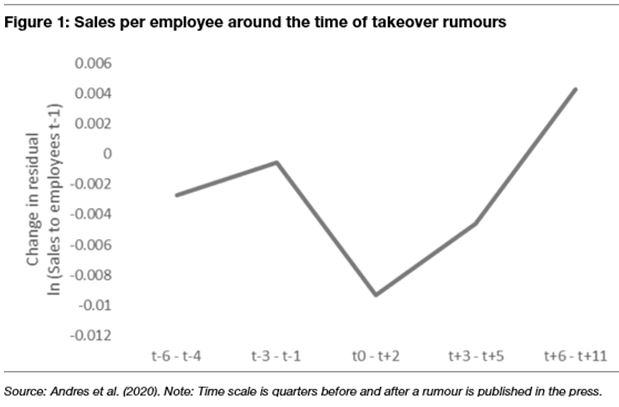

Imagine you work at a company and you hear the news that your firm may be subject to a takeover by a competitor or a private equity firm. How would you feel? Those of you who have been at the receiving end of such rumours know that most people will feel anxious and concerned they might lose their job. Others may start to look for another job right away. In any case, most people in the target firm will likely be distracted. And that means that their productivity at work declines. A group of German and American researchers investigated how much productivity drops in reaction to a takeover rumour. Based on their analysis of more than 10,000 takeover rumours in some 40 countries they found that in the six months after a rumour was spread by the press, sales per employee dipped by 1%. For the whole year that is a decline of total sales by 0.5% compared to companies that weren’t the subject of rumours. And it takes about 1 to 1.5 years for sales to recover to pre-rumour levels. It’s not nothing.

The effects are by the way not due to customers turning their backs on the takeover target. They are due to internal loss of productivity. And the loss of productivity is greater in countries like the United States where social safety nets are weaker and the loss of a job is more of a threat to the standard of living than in other countries.

This is why laws like the UK takeover code of 2011 are helpful. The UK Takeover Code has the wonderful “put up or shut up” rule that forces an acquirer to publicly clarify its intention within 28 days. This dramatically limits the uncertainty in financial markets, but also in the target company and thus limits the damage done to its operations.

Thought of the Week features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to joachim.klement@liberum.com. This publication is free for everyone.